Last Day For Ira Contribution 2024

Last Day For Ira Contribution 2024. Ira contribution limits for 2024. Roth ira and ira contribution deadlines 2023.

You have until tax day for 2023—which is april 15, 2024—to make ira contributions that reduce your taxable income for 2023. 401(k) limit increases to $23,000 for 2024, ira limit rises to $7,000. internal revenue service.

If You Have Access To Some Other.

401(k) limit increases to $23,000 for 2024, ira limit rises to $7,000. internal revenue service.

Filing Status 2023 Modified Agi 2024 Modified Agi Contribution Limit;

1, 2024, you can also make contributions toward your 2024.

For 2024, The Maximum Amount That A Business Can Contribute To A Sep Ira For Each Employee Is The Lesser Of:

Images References :

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

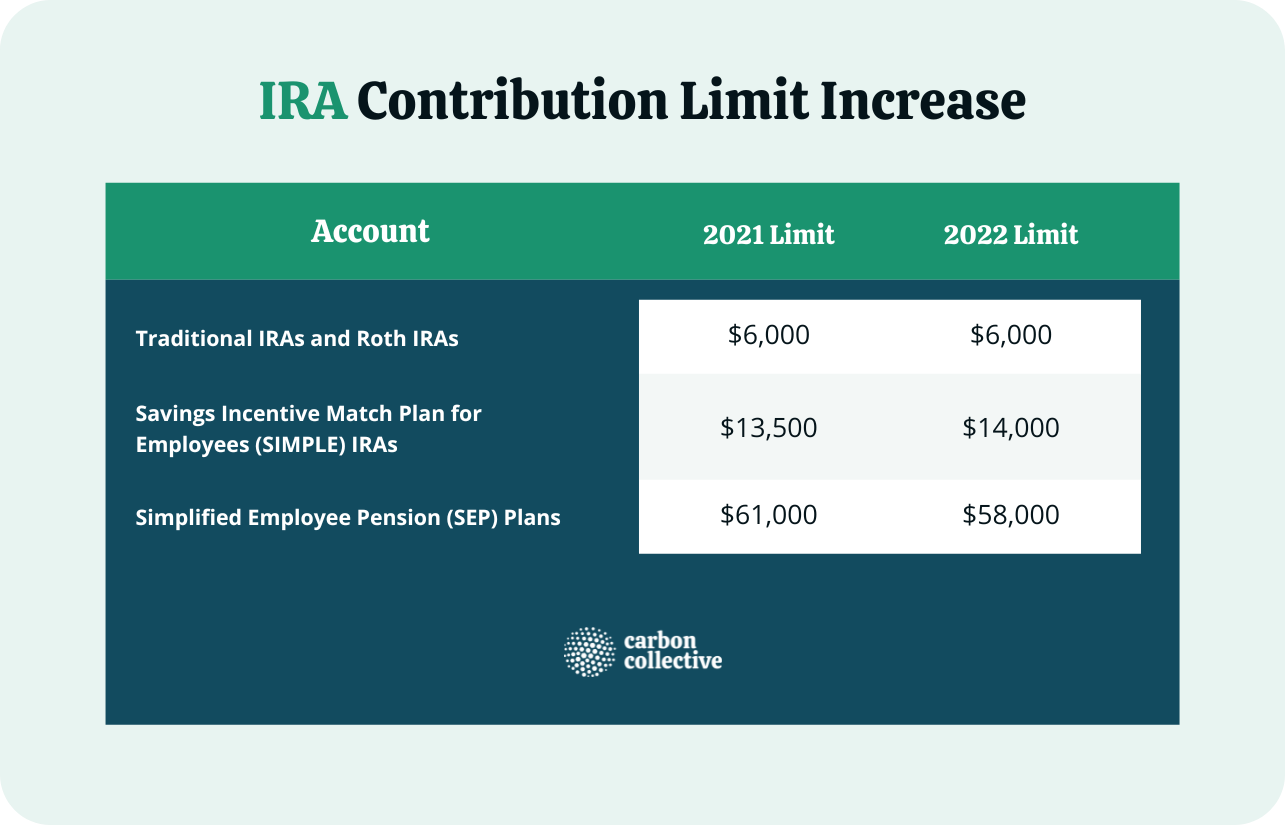

The IRS just announced the 2022 401(k) and IRA contribution limits, The contribution limit for a simple ira is $15,500 for 2023 and $16,000 for 2024. You have until tax day for 2023—which is april 15, 2024—to make ira contributions that reduce your taxable income for 2023.

Source: meldfinancial.com

Source: meldfinancial.com

IRA Contribution Limits in 2023 Meld Financial, You have until tax day for 2023—which is april 15, 2024—to make ira contributions that reduce your taxable income for 2023. So you can make a 2023 ira contribution until april 15, 2024—but we don't recommend waiting.

Source: www.jackiebeck.com

Source: www.jackiebeck.com

IRA Contribution Limits for 2024, 2023, and Prior Years, If you have a tax extension , you must make the contributions by the end of the extension period. So you can make a 2023 ira contribution until april 15, 2024—but we don't recommend waiting.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, In 2024, that means you can contribute toward your 2023 tax year limit of $6,500 until april 15. The earlier you contribute to an ira, the.

Source: www.carboncollective.co

Source: www.carboncollective.co

IRA Contribution Limits in 2022 & 2023 Contributions & Age Limits, In 2024 you can make up to $105,000 of qcds. (this plan does not offer an extended period to set up in 2024 and count towards 2023.) contributions:.

Source: www.blog.passive-income4u.com

Source: www.blog.passive-income4u.com

IRA Contribution Limits And Limits For 2023 And 2024, $69,000 ($66,000 for 2022 contributions); In 2024, that means you can contribute toward your 2023 tax year limit of $6,500 until april 15.

Source: www.carboncollective.co

Source: www.carboncollective.co

IRA Contribution Limits in 2022 & 2023 Contributions & Age Limits, Filing status 2023 modified agi 2024 modified agi contribution limit; You can also make a 2024 ira contribution between january 1,.

Source: choosegoldira.com

Source: choosegoldira.com

self directed 401k contribution limits 2022 Choosing Your Gold IRA, The maximum annual traditional ira contribution limit is $7,000 in 2024 ($8,000 if age 50 or older). If you have a traditional ira or roth ira, you have until the tax deadline, or april 15, 2024, to make contributions for the.

Source: 12022c.blogspot.com

Source: 12022c.blogspot.com

What Is The Ira Contribution Limit For 2022 a2022c, 2023 and 2024 roth ira income limits; Married filing jointly or qualifying widow(er) less.

Source: michaelryanmoney.com

Source: michaelryanmoney.com

IRA Contribution Deadline Last Day to Contribute to Roth IRA (2022/, $69,000 ($66,000 for 2022 contributions); As a general rule, you have until tax day to make ira contributions for the prior year.

Traditional &Amp; Roth Ira Contribution Deadlines.

In 2023 and 2024, the annual contribution.

1, 2024, You Can Also Make Contributions Toward Your 2024.

For the 2023 contribution year, the deadline is april 18, 2024.